News -

Cash transactions at Post Offices show sustained strong demand for cash throughout summer months

- Post Offices handled £3.64bn in cash deposits and withdrawals in August

- Across the UK, there was a strong year-on-year increase in business and personal cash deposits

- Personal cash deposits across the UK exceeded £1.52bn, a 13.74% year-on-year increase, whilst business cash deposits exceeded £1.18bn across the UK, a 3.86% increase year-on-year

- Wales experienced a particularly strong level of cash deposits and withdrawals increase, reaching £223 million, a year-on-year rise of 10.62%

New figures released today reveal Post Offices handled £3.61 billion in cash deposits and withdrawals in August. The total cash deposits value totalled £2.7bn, a slight decline compared to July’s record-breaking numbers, but a year-on-year increase of +9.2%. Cash withdrawals amounted to £934m million, a 8.1% rise YoY.

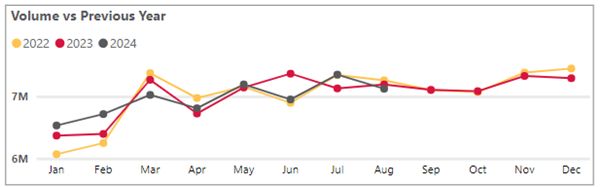

Demand for cash amongst Post Office customers has remained strong throughout the summer months, with August’s £3.61bn figure just shy of the record breaking £3.77 billion in cash deposits and withdrawals in July, as well as two consecutive record-breaking months for cash handling at Post Offices in April (£3.49 billion) and May (£3.57 billion).

Personal cash deposits across the UK exceeded £1.52 billion, reflecting a significant year-on-year increase of 13.74%. Business cash deposits also saw growth, reaching over £1.18 billion across the UK, a 3.86% increase compared to the same period last year. These increases demonstrate the ongoing reliance on cash for both individuals and businesses in navigating their financial transactions.

Across the UK there was a strong year-on-year increase for business and personal cash deposits and withdrawals. Wales experienced a particularly strong level of cash deposits and withdrawals increase, reaching £223 million, a year-on-year rise of 10.62%. In England, cash deposits reached £2.2 billion, experiencing a 9.8% growth year-on-year. Northern Ireland experienced a 2% month-on-month increase in cash withdrawals, amounting to £64m for August 2024.

Ross Borkett, Banking Director at Post Office, said: "Our figures show that demand for cash remained strong through August, as both individuals and businesses continue to rely on it. Many individuals are turning to cash as a trusted method for managing their day-to-day expenses, while businesses continue to rely on physical transactions to adapt to market fluctuations and uncertainties. Postmasters and their teams play a crucial role in helping small businesses stay afloat by offering a secure and convenient place to deposit cash takings, with many branches offering extended hours and weekend availability.”

Post Office Cash tracker data – August 2024

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for August 2024 | |

UK[1] | £2.70bn | -4.4% | +9.2% | £935m | -1.8% | +8.1% | £3.64bn |

England | £2.24bn | -5.0% | +9.8% | £731m | -2.5% | +8.4% | £2.97bn |

Scotland | £186m | -0.8% | +6.3% | £64m | +1.0% | +3.8% | £249m |

Wales | £147m | -1.0% | +11.0% | £76m | -0.5% | +10.0% | £223m |

Northern Ireland | £129m | -2.2% | +1.2% | £64m | +2.0% | +6.1% | £193m |

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

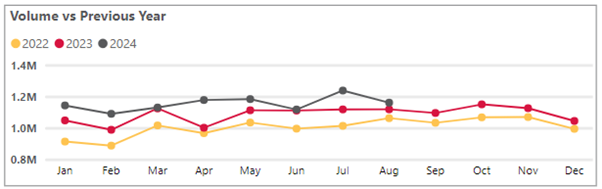

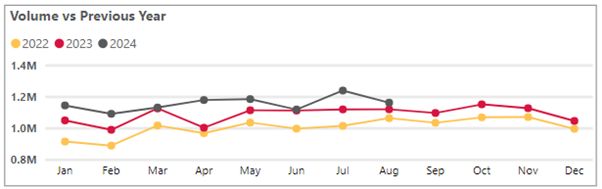

Business cash deposits

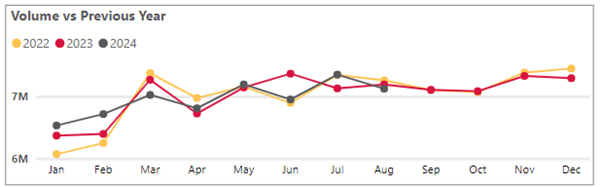

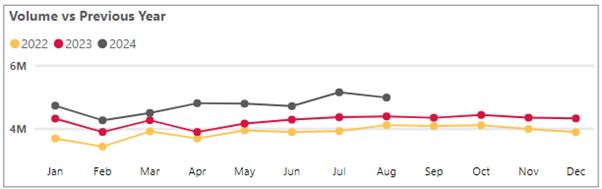

Personal cash withdrawals

Banking Hubs

As at 16 July, 66 hubs have been opened in partnership between Cash Access UK and the Post Office. 147 Banking Hubs have now been announced by LINK with further openings planned for later this year.

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.