Press release -

Business Cash deposits up over 3% month-on-month in October

- Business cash deposits totalled £1.12 billion in October, up 3.3% month-on-month (£1.09 billion, September 2023)

- Personal cash deposits and withdrawals were relatively flat month-on-month with £1.32 billion deposited by personal customers (+0.8% month-on-month) and £821 million withdrawn (+0.5% month-on-month)

- In total, £3.3 billion worth of cash was deposited and withdrawn over the counter at Post Office’s 11,500 branches. That compares to £3.25 billion in September

New figures today reveal business cash deposits at Post Offices were up 3.3% in October compared with the previous month.

Business cash deposits totalled £1.12 billion in October compared with £1.09 billion in September indicating businesses are starting to see an increase in cash transactions as the festive season starts to get underway.

Personal cash deposits totalled £1.32 billion in October, up 0.8% month-on-month (£1.31 billion, September 2023). Personal cash deposits dipped 0.8% year-on-year (£1.33 billion, October 2022).

Overall, the volume of cash deposit transactions was up over 550,000 year-on-year (+10.2%). Business cash deposit volumes alone were over 8% higher than last year indicating that businesses are responding to bank-imposed cash limits by depositing smaller values but at higher volumes at their local Post Office. Post Offices continue to play a critical role in the survival of small businesses as they enter the Christmas period providing convenient and secure locations to deposit cash takings. A recent independent report by London Economics found that two out of five SMEs (39%) believe that the availability of cash and banking services at Post Offices is important.

Personal cash withdrawals at Post Offices across the UK totalled £821 million in October. This was up 0.5% month-on-month (£818 million, September 2023). Personal cash withdrawals were up almost 6% year-on-year (£777 million, October 2022).

In total, £3.3 billion worth of cash was deposited and withdrawn over the counter at Post Office’s 11,500 branches. That compares to £3.25 billion in September.

Martin Kearsley, Post Office Banking Director, said:

“For many people and businesses, cost of living challenges remain. The increase in value and volume of business cash deposits does indicate the continuing importance of cash in many peoples’ lives, and businesses are having to adjust to the bank-imposed limits on how much they can deposit each time. Postmasters are here to support their local communities with all of their cash needs and particularly in the run-up to Christmas as people use cash to budget and businesses rely on somewhere open long hours to deposit much needed cash takings.”

The over £3 billion worth of cash transactions at Post Office branches have been driven by continued bank branch closures, highlighting the importance of Post Offices within communities. Since 2015, a total of 5,632 banks and building societies have closed or are scheduled to close and over 500 bank branch closures have been announced for 2023 so far.

Post Office has partnerships with over 30 banks, building societies and credit unions meaning that 99% of UK bank customers can access their accounts at their Post Office branch.

Post Office Cash tracker data – October 2023

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for October 2023 | |

UK[1] | £2.44bn | +1.9% | -0.3% | £852.1m | +0.4% | +5.9% | £3.30bn |

England | £2.03bn | +2.2% | +0.2% | £667.0m | +0.3% | +6.5% | £2.70bn |

Scotland | £162.9m | -0.1% | -5.5% | £59.1m | +1.2% | +2.7% | £222.0m |

Wales | £125.9m | +0.8% | +0.3% | £67.0m | +0.6% | +3.2% | £192.9m |

Northern Ireland | £124.9m | +1.5% | -2.1% | £59.1m | +0.5% | +5.7% | £184.0m |

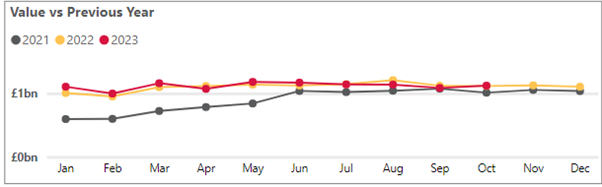

Business cash deposits

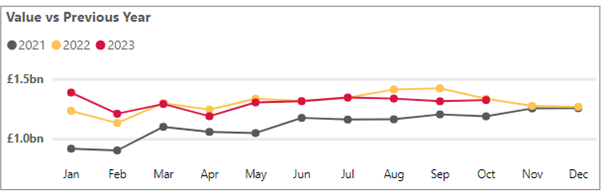

Personal cash deposits

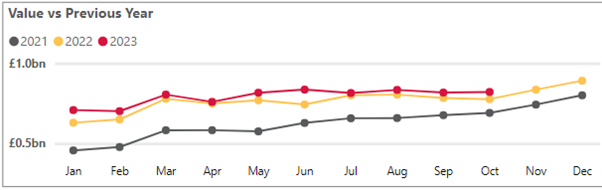

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; and; bill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.