Press release -

Business cash deposits up over 7% in May at Post Offices; personal cash deposits and withdrawals hold steady during one of wettest May’s on record

- Total value of cash deposits and withdrawals at Post Offices totalled £2.49 billion in May, up on April (£2.45 billion)

- Business cash deposits in May totalled £824 million, up 7.2% month-on-month (£769 million, April 2021). In Scotland, business cash deposits were up almost 36% month-on-month (£68.7 million in May)

- Personal cash deposits exceeded £1 billion for the third successive month totalling £1.06 billion, broadly in line month-on-month (£1.07 billion, April 2021)

- Personal cash withdrawals totalled £583 million over the counter, similar to April (£589 million, April 2021)

- Post Offices are providing critical cash services to non-essential retailers who can rely on Post Office branches to deposit much needed cash takings as they are open long hours and many seven days a week

Latest data from the Post Office’s May Cash Tracker shows overall cash deposits and withdrawals increased month-on-month, highlighting that cash use continues to recover. Record levels of rainfall in May in parts of England and Wales contribute to flat personal cash deposits and withdrawals for first time since start of the year, but there was continued growth in business deposits.

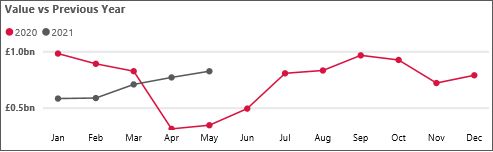

Business cash deposits totalled £824 million, up 7.2% month-on-month (£769 million, April 2021). In comparison with May 2020 (£345 million) when the UK was in the second full month of lockdown, business cash deposits are up 139% year-on-year. In Scotland, in May business cash deposits were up almost 36% month-on-month (£68.7 million) as lockdown measures continued to ease.

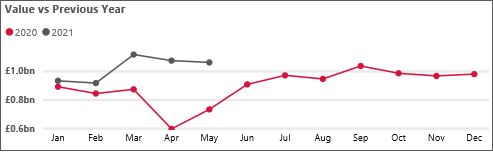

Personal cash deposits exceeded a billion pounds for the third successive month. In May, £1.06 billion was deposited over the counters, broadly in line with April (£1.07 billion).

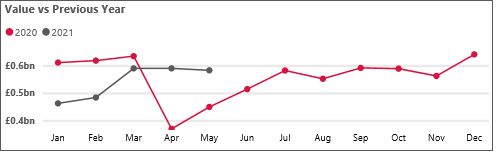

Personal cash withdrawals totalled £583 million in May, similar to April (£589 million, April 2021).

May was the first time since January that personal cash withdrawals had levelled off month-on-month and the first time since February that personal cash deposits had slowed month-on-month which Post Office attributes to the wet weather seen across many parts of the UK last month.

Overall, cash deposits and withdrawals at Post Offices in May amounted to £2.49 billion. This compares with £2.45 billion in April and £2.44 billion in March.

Martin Kearsley, Banking Director at Post Office, said:

“Despite one of the wettest Mays on record, overall cash deposits and withdrawals continue to recover as non-essential retailers had their first full month of trading since last year. Personal cash deposits topping a billion pounds for the third month in a row highlights how important it is that both individuals and businesses have somewhere local where they can deposit their cash. Despite the relentless wet weather, Postmasters continued to keep their branches open serving their local communities with all of their cash needs.”

Post Office Cash tracker data – May 2021

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for May 2021 | |

UK[1] | £1.88bn | +2.3% | +75.0% | £605.5m | -1.2% | +29.4% | £2.49bn |

England | £1.54bn | +1.1% | +79.6% | £471.8m | -1.6% | +29.5% | £2.01bn |

Scotland | £147.0m | +14.0% | +70.6% | £48.1m | -0.6% | +19.4% | £195m |

Wales | £96.7m | +3.3% | +57.7% | £50.5m | -0.8% | +25.1% | £147.2m |

Northern Ireland | £102.4m | +5.4% | +41.1% | £35.1m | +2.8% | +53.2% | £137.5m |

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

Ends

About Post Office Cash Tracker and access to cash

Data included in this press release reflects cash services used under the Banking Framework. Over 30 banks and building societies are part of the Banking Framework which enables their customers to withdraw or deposit cash at any of the Post Office’s 11,500 branches. The figures exclude Post Office Card Account withdrawals.

Post Office is central to the success of the Community Access to Cash Pilots initiative led by Natalie Ceeney, Chair of the Access to Cash Review. Two ‘BankHubs’ – providing dedicated retail space on the high street, combining the cash-transaction facilities of a Post Office with access to community banking services offered by retail banks – opened in April and will be piloted for 6 months.

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; andbill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.