Press release -

Cash deposits and withdrawals at Post Offices remain steady at £3.2 billion

- £3.21 billion in cash handled by Post Offices in June. Broadly the same amount month-on-month (£3.27 billion, May 22).

- Personal cash deposits totalled £1.33 billion in June compared with £1.35 billion (May 22).

- Business cash deposits exceeded £1 billion for fourth month in a row with £1.11 billion deposited in June compared with £1.13 billion in May

- New poll finds one in five consumers will use cash instead of card to help with budgeting in light of the Cost of Living crisis

- Post Office running its ‘Save our Cash’ campaign to highlight vital role having access to cash will play in advance of further Cost of Living pressures expected later this year

New figures today reveal Post Offices handled over £3.2 billion in cash in June. This was the fourth successive month where over £3 billion has been deposited and withdrawn in a single month.

Personal cash deposits totalled £1.33 billion in June compared with £1.35 billion in May. In Northern Ireland, personal cash deposits exceeded £100 million in a single month for the second month in a row with £100.2 million deposited. Personal cash deposits are far higher in Northern Ireland than in Scotland (£90.0 million) or Wales (£68.4 million).

Business cash deposits totalled £1.11 billion in June compared with £1.13 billion in May. This was the fourth month in a row business cash deposits had exceeded £1 billion in a single month.

Personal cash withdrawals totalled £744 million in June, dipping 3.4% month-on-month (£770 million, May 22).

Overall, £3.21 billion in cash was handled by Post Offices in June. This compares with £3.27 billion in May, £3.14 billion in April and £3.2 billion in March.

A new Post Office poll* has found that one in five UK consumers will use cash instead of card payments to help with budgeting in light of the rising cost of living. Over a third of respondents (36%) said they would cancel entertainment and leisure subscriptions such as Netflix or the gym. As many more people choose to control their household budgets by spending only what they physically have in their hands, Post Office is once again running its ‘Save Our Cash’ campaign in July.

Martin Kearsley, Banking Director at Post Office, said:

“Postmasters continuing to handle well over £3 billion each month demonstrates just how vital being able to deposit and withdraw cash, securely and conveniently, is for millions of people. Many people will be budgeting now for further financial pressures expected in the autumn. Using cash to budget has been tried and tested for hundreds of years and it’s why we are running our ‘Save our Cash’ campaign to highlight just how important being able to budget with cash is for so many people.”

Post Office Cash tracker data – June 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for June 2022 | |

UK[1] | £2.44bn | -1.3% | +10.2% | £770.0m | -3.4% | +16.6% | £3.21bn |

England | £2.01bn | -1.2% | +10.7% | £598.3m | -3.7% | +16.2% | £2.61bn |

Scotland | £178.5m | -1.5% | +6.1% | £57.3m | -1.0% | +10.9% | £235.8m |

Wales | £123.3m | -2.6% | +7.8% | £61.8m | -4.4% | +12.0% | £185.1m |

Northern Ireland | £128.4m | -0.6% | +12.1% | £52.5m | -2.0% | +35.5% | £180.9m |

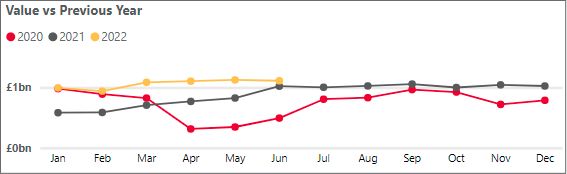

Business cash deposits

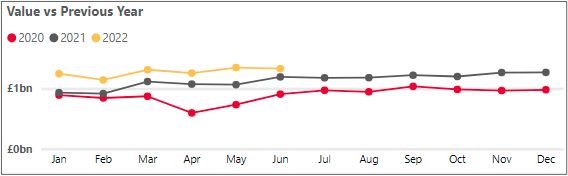

Personal cash deposits

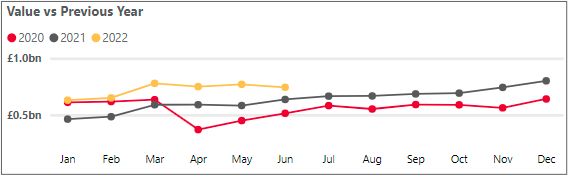

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

* Online survey carried out with Dynata, speaking to 2004 adults aged 16+. Fieldwork between 22-29 June

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.