Press release -

Cash deposits and withdrawals on course to top £3 billion a month at Post Offices

- Post Offices handled almost £3 billion in cash deposits and withdrawals in a single month (£2.99 billion, September 2021)

- Post Offices have already had the busiest first week for cash ever in October and deposits and withdrawals expected to exceed £3 billion this month

- The £2.99 billion figure is the highest ever in a single month so far and demonstrates that despite impending contactless increase to £100, millions of people and businesses rely on cash daily

- The continuation of bank branch closures sees thousands of their customers directed to Post Offices for their cash needs and they’re staying with Post Office where many branches are open long hours and at weekends

- Post Offices handled £1.06 billion in business cash deposits in September, up over 3% month-on-month (£1.03 billion, August 2021) and up over 9.5% up on a year ago (£965 million, September 2020)

- Personal cash deposits were over £1.2 billion in September whilst £685 million was withdrawn over the counter at Post Office’s 11,500 branches

Post Offices in September handled almost £3 billion in cash deposits and withdrawals.

As banks continue to close branches or announce forthcoming closures, Post Office expects to shortly exceed £3 billion in monthly cash deposits and withdrawals for the first time in its 360-year history.

Despite the impending increase to contactless payments from £45 to £100 this Friday (15 October), £1.06 billion was deposited by business customers in September. This was up 3.1% month-on-month (£1.03 billion, August 2021) and up 9.6% year-on-year (£965 million).

A recent Post Office survey found nearly half (44%) of small hospitality and leisure businesses in the UK rely on cash daily. A third (34%) of hospitality and leisure business owners said they would fear for the security of their business if they didn’t have the ability to deposit cash at the end of each day. Post Office recently launched a ‘Save Our Cash’ campaign calling for the Government to speed up legislation to protect access to cash for the millions of people and businesses that rely on it.

In total, £2.99 billion was deposited and withdrawn by personal and business customers in September, the highest ever amount in a single month, and a demonstration of the daily reliance on cash that millions of businesses and consumers have. In August, the figure was £2.90 billion.

Martin Kearsley, Banking Director at Post Office, said:

“Each month brings news of further bank branch closures, and in many communities across the country Post Office is already the last counter in town. Despite the impending increase in contactless payments, we know that small businesses in particular recognise the value of cash now more than ever. We’re preparing for continued increases at our branches as Postmasters support local businesses in their community by staying open long hours and weekends, providing a convenient and secure place for businesses and the self-employed to deposit much needed cash takings.”

Personal cash deposits

Personal cash deposits exceeded a billion pounds for the seventh successive month. In September, £1.22 billion was deposited over the counters which was 3.5% up month-on-month (£1.18 billion, August 2021).

Personal cash withdrawals

Personal cash withdrawals in September 2021 totalled £685 million, up 2.7% on August (£667 million). Personal cash withdrawals were up almost 16% year-on-year (£591 million, September 2020).

Post Office Cash tracker data – September 2021

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for September 2021 | |

UK[1] | £2.28bn | +3.3% | +13.9% | £710.9m | +2.8% | +15.6% | £2.99bn |

England | £1.87bn | +3.9% | +15.2% | £556.5m | +3.2% | +14.8% | £2.43bn |

Scotland | £169.9m | -1.2% | +10.7% | £53.2m | +0.1% | +12.6% | £223m |

Wales | £118.1m | +0.4% | +9.3% | £57.9m | +1.2% | +13.0% | £176m |

Northern Ireland | £114.8m | +3.8% | +2.8% | £43.3m | +3.8% | +38.3% | £158m |

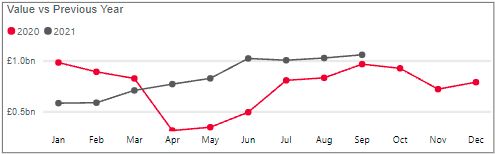

Business cash deposits

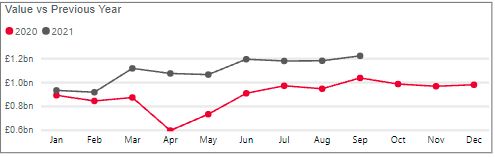

Personal cash deposits

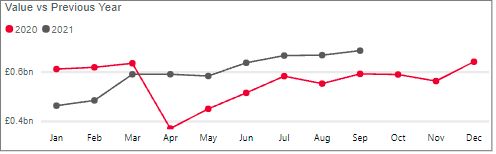

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.