Press release -

Cash deposits fall 2% month-on-month at Post Offices, hit by new bank deposit limits; whilst personal cash withdrawals hit a record £836 million

- Post Offices handled £2.4 billion in personal and business cash deposits in November, a 2% fall month-on-month (£2.45 billion, October 2022)

- Post Office has attributed the fall to newly introduced deposit limits that are being set by banks in response to FCA concerns about money laundering

- As a result, business cash deposits only grew by 0.8% month-on-month at a time of year when Post Office would expect significant increase in business cash deposits

- This raises the concern that these limits are impacting legitimate personal and business customers and their access to local deposit facilities

- In contrast, personal cash withdrawals totalled a record £836 million in November, beating the previous record by over £30 million (£805 million, August 2022)

- In total, £3.27 billion in cash was deposited and withdrawn over the counter at Post Offices in November, compared with £3.26 billion in October

New figures today reveal a fall in cash deposits at Post Offices in November but record levels of cash withdrawals as people continue to turn to cash in order to budget over Winter.

Personal and business cash deposits totalled £2.4 billion in November, overall a 2% fall month-on-month (£2.45 billion, October 2022). Personal cash deposits accounted for £1.29 billion, a 4.4% fall on October (£1.35 billion) and down on September, when personal cash deposits totalled £1.43 billion.

November 2022 was the first time since the start of the year (January and February 2022) that personal cash deposits had fallen for two successive months.

November traditionally sees large increases in business cash deposits as the hospitality and leisure sectors take advantage of the run-up to Christmas, but business cash deposits only grew 0.8% month-on-month totalling £1.11 billion in November (£1.1 billion, October 2022).

Post Office has attributed the fall in cash deposits to newly introduced deposit limits that the banks have set as part of a tightening of money laundering controls. This has resulted in limits on the amount of cash that can be deposited over the counter at Post Offices.

Martin Kearsley, Banking Director at Post Office, said:

“Many businesses rely on cash takings in order to survive, as do their customers. Over-zealous limits imposed on the amount they are able to deposit will almost certainly result in more businesses simply no longer being able to accept cash. This will impact their ability to trade successfully and impacts the millions of people who rely on cash as their only means to pay for goods and services. We are working with the industry and others to encourage changes to these implementations so that businesses across the country can continue to deposit their cash takings at their local Post Office without worrying about limits set by their bank.”

Personal cash withdrawals

Personal cash withdrawals totalled a record £836 million in November. This exceeded the previous record by over £30 million (£805 million, August 2022). Personal cash withdrawals in November were up 7.6% month-on-month and 12.5% year-on-year.

The increase in personal cash withdrawals coincides with the Post Office’s renewed partnership with the Trussell Trust. From November, Post Office will again donate 1p from every cash withdrawal and hopes to raise £330,000 for the charity over the winter. In addition, Post Offices are also providing energy relief payments, winter fuel payments and cost of living payments in cash on behalf of the Government and local councils to vulnerable people.

Martin Kearsley added:

“Millions of people continue to visit their local Post Office to withdraw cash in order to budget and Postmasters are playing a vital role in helping people, particularly those on low incomes, navigate this Winter. In addition to cash deposit and withdrawal services, Postmasters are processing tens of thousands of Energy Bill Support Scheme discounts for prepaid meter customers every week.”

Post Office Cash tracker data – November 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for November 2022 | |

UK[1] | £2.40bn | -2.1% | +4.0% | £865.4m | +7.5% | +12.5% | £3.27bn |

England | £1.99bn | -1.9% | +4.9% | £675.8m | +7.9% | +12.6% | £2.66bn |

Scotland | £166.7m | -3.5% | -2.5% | £61.2m | +6.3% | +6.3% | £228.0m |

Wales | £120.3m | -4.2% | +1.0% | £68.4m | +5.3% | +10.5% | £188.7m |

Northern Ireland | £127.0m | -0.4% | +2.0% | £60.0m | +7.3% | +21.0% | £187.0m |

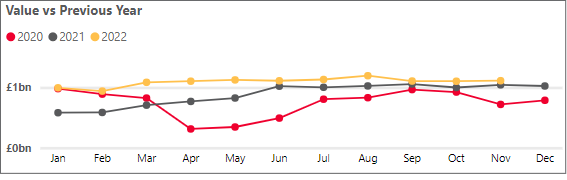

Business cash deposits

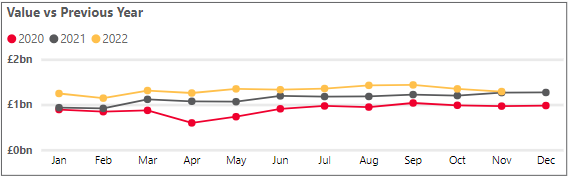

Personal cash deposits

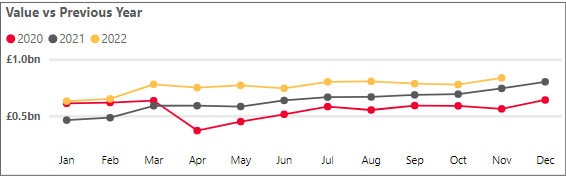

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.