Press release -

Cash transactions at Post Offices return to highest level since last September

- Cash deposits and withdrawals totalled £3.29 billion in March. Excluding Christmas (£3.294 billion), this was the highest amount of cash handled by Post Offices since last September (£3.35 billion) despite challenging market conditions and deposit limits set by banks.

- Personal cash withdrawals totalled £805 million in March, far exceeding February (£702 million) and January (£709 million).

- Business cash deposits totalled £1.15 billion in March, up over 16% month-on-month (£985 million, February 2023).

- Personal cash deposits totalled £1.3 billion in March, up 6.7% month-on-month (£1.22 billion, February 2022).

- Post Office recently announced a 20% increase in the remuneration it pays Postmasters for handling cash deposits from April 2023, building on a doubling in the per transaction rate for handling deposits announced last August.

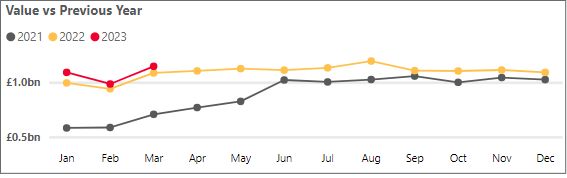

New figures today reveal cash transactions at Post Offices returned to their highest level since last September. In March, cash deposits and withdrawals over the counter amounted to £3.29 billion at its 11,500 branches.

Excluding Christmas when cash withdrawals are usually at their highest (£3.294 billion was deposited and withdrawn in December), last September was the previous high when £3.35 billion was deposited and withdrawn over the counter at Post Offices.

Post Office has been warning since last Decemberthat cash deposit limits introduced by the banks and requested by the FCA as part of a tightening of money laundering controls have had a significant impact on Postmasters. Post Office attributes March’s increase in cash deposits to increased footfall as a result of continued bank branch closures. Despite the imposition of cash deposit limits.

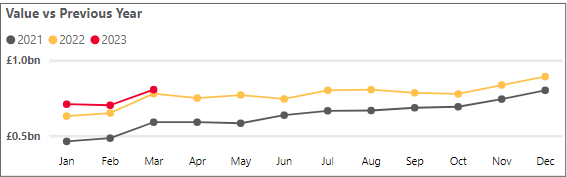

Personal cash withdrawals in March totalled £805 million. Up almost 15% month-on-month (£702 million, February 2023).

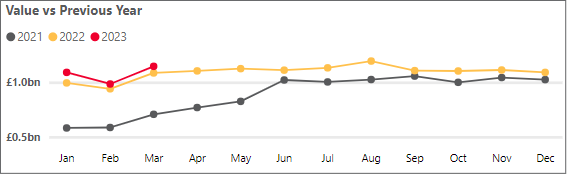

Business cash deposits totalled £1.15 billion in March. Up over 16% month-on-month (£985 million, February 2023). Business cash deposits were at their highest level since last August when £1.19 billion was deposited by business customers.

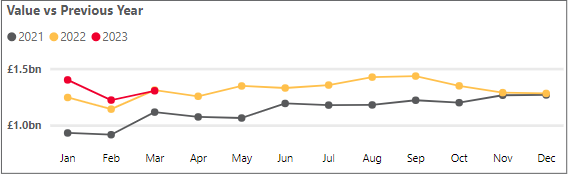

Personal cash deposits totalled £1.3 billion in March. Up 6.7% month-on-month (£1.22 billion, February 2023). However, personal deposits dipped 0.5% year-on-year (£1.31 billion, March 2022) which Post Office attributes to continuing cash deposit limits imposed by banks on their customers.

At the end of March, Post Office announced a £26 million package of remuneration improvements for Postmasters. This includes, effective April 2023, a 20% increase in the remuneration Post Office pays Postmasters for handling cash deposits, building on a doubling in the per transaction rate for handling deposits announced last August. The announcement reflects the increasing reliance thousands of communities have on everyday banking facilities at their local Post Office and follows a number of recent announcements from banks and building societies regarding closures in 2023.

In March 2023 there were almost 5.7 million cash deposit transactions at Post Offices. That was up over 10% month-on-month and over 11% year-on-year. Last April, there were 4.86 million cash deposit transactions.

Martin Kearsley, Post Office Banking Director, said:

“It’s encouraging to see such a significant amount of cash handled by our Postmasters last month despite on-going cost of living challenges, new deposit limits, and continued tough retail conditions on the High Street. Postmasters rightly tell us that the bank branch closures mean they are the only location where consumers and businesses can do their banking, which is why we’re increasing banking deposit remuneration by 20%.

“We’re looking forward to operating many more Bank Hubs over the course of this year, as the roll out gathers pace, and supporting communities that have seen their local bank branch close.

“Naturally when it’s announced that the last bank branch is closing in a town it creates much concern amongst residents and businesses. Our Area Managers are supporting Postmasters to reassure the community that everyday banking can be done at a Post Office with dedicated marketing materials or with stands at the closing branch.”

Post Office Cash tracker data – March 2023

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for March 2023 | |

UK[1] | £2.45bn | +11.1% | +2.3% | £835.7m | +14.8% | +3.6% | £3.29bn |

England | £2.03bn | +14.4% | +2.5% | £651.6m | +14.8% | +3.6% | £2.68bn |

Scotland | £165.0m | +11.6% | -3.0% | £58.4m | +14.8% | +0.5% | £223.4m |

Wales | £119.8m | +11.1% | +0.1% | £64.8m | +12.7% | +0.8% | £184.6m |

Northern Ireland | £137.9m | -22.4% | +8.0% | £60.9m | +18.2% | +9.8% | £198.8m |

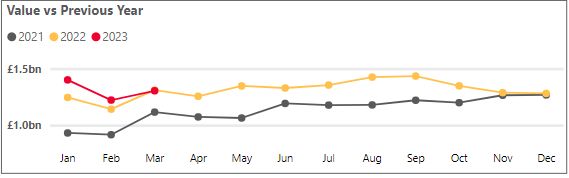

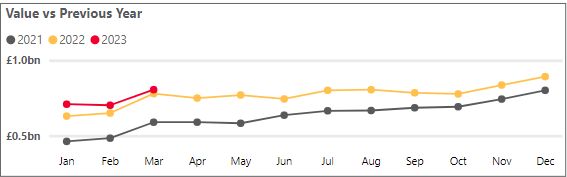

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.