Press release -

Cash transactions at Post Offices show sustained demand throughout September

- Post Offices handled £3.55bn in cash deposits and withdrawals in September

- Across the UK, there was a strong year-on-year increase in business and personal cash withdrawals, up 6.5%

- Personal cash deposits across the UK exceeded £1.48bn, reflecting a significant year-on-year increase of 13.2%

- Business cash deposits exceeded £1.16bn across the UK, an increase year-on-year of 7.2%

- Across the UK there was a strong year-on-year increase for business and personal cash deposits and withdrawals, with Wales experiencing the highest year-on-year increase of 7.7% in withdrawals and 12.7% in cash deposits

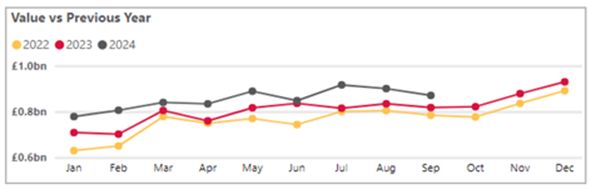

New figures released today reveal Post Offices handled £3.55 billion in cash deposits and withdrawals in September. The total cash deposits value totalled £2.65bn, a slight decline compared to this summer’s record-breaking numbers, but a year-on-year increase of 10.5%. Cash withdrawals amounted to £903.92m, a 6.5% rise YoY. There was also a strong year-on-year increase in business and personal cash withdrawals, totalling 6.32%.

Demand for cash amongst Post Office customers has remained strong into the Autumn months. September's figure of £3.55 billion is just short of the record-breaking £3.77 billion in cash deposits and withdrawals seen in July. This followed two consecutive record-breaking months for cash handling at Post Offices in April (£3.49 billion) and May (£3.57 billion).

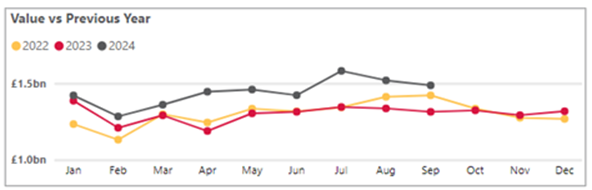

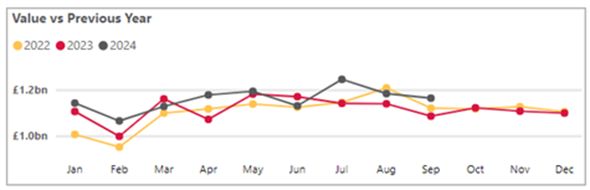

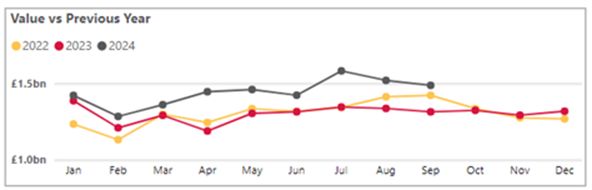

Business cash deposits across the UK saw growth, reaching over £1.16bn, an increase of 7.2% compared to the same period last year. Personal cash deposits across the UK exceeded £1.48bn, reflecting a significant year-on-year increase of 13.2%. These increases demonstrate the ongoing reliance on cash for both individuals and businesses in navigating their financial transactions.

Regionally, there was also a strong year-on-year increase for business and personal cash deposits and withdrawals. Wales experienced the largest year-on-year increase of 7.7% in cash withdrawals and 12.7% in cash deposits. In England, business and personal cash deposits reached £2.21 billion, reflecting a 11.0% growth year-on-year. Northern Ireland also experienced a noteworthy 6.8% year-on-year increase in cash withdrawals, highlighting strong cash handling activity in the region.

Ross Borkett, Banking Director at Post Office, said: "Our September figures show that demand for cash remained strong into the start of Autumn, as both individuals and businesses continue to rely on it. Many individuals continue to use cash as a trusted method for managing their day-to-day expenses, while businesses continue to rely on physical transactions to adapt to market fluctuations and uncertainties. Postmasters and their teams play a crucial role in helping small businesses thrive by offering a secure and convenient place to deposit cash takings, with many branches offering extended hours and weekend availability.”

Post Office Cash tracker data – September 2024

| Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for September 2024 | |

| UK[1] | £2.65bn | -1.9% | +10.5% | £903.92m | -3.3% | +6.5% | £3.55bn |

| England | £2.21bn | -1.5% | +11.0% | £708.70m | -3.1% | +6.6% | £2.92bn |

| Scotland | £175.39m | -5.6% | +7.7% | £60.80m | -4.3% | +4.2% | £236.19m |

| Wales | £140.84m | -4.3% | +12.7% | £71.75m | -5.0% | +7.7% | £212.59m |

| Northern Ireland | £127.05m | -1.3% | +3.5% | £62.67m | -2.6% | +6.8% | £189.72m |

Business cash deposits

Personal cash deposits

Personal cash withdrawals

Banking Hubs

As at 16 July, 66 hubs have been opened in partnership between Cash Access UK and the Post Office. 147 Banking Hubs have now been announced by LINK with further openings planned for later this year.

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; and; bill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.