Press release -

February cash deposits flat month-on-month during lockdown, while personal cash withdrawals up 4.6%

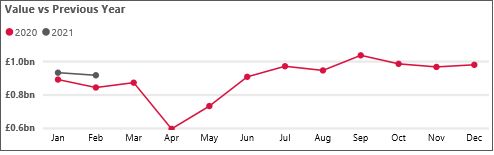

- Personal and business cash deposits at Post Offices totalled £1.5 billion in February, down 0.7% compared with January and down 13.3% year-on-year (£1.73 billion)

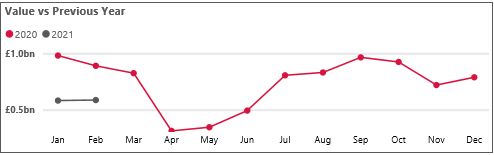

- Business cash deposits totalled £586 million. This was down 34% compared with February last year (£890 million). For comparison, in January there was a 40% fall in business cash deposits year-on-year (£582 million in January 2021 as opposed to £981 million in January 2020)

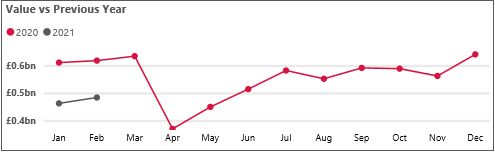

- Personal cash withdrawals totalled £484 million in February. This was up 4.6% compared with January (£463 million). The figure is almost 22% down on the same month last year (£618 million) before the outbreak of Covid-19 in the UK

- 99% of Post Offices remain open throughout this national lockdown, providing customers with essential banking, mails and bill payments services

Latest data from the Post Office’s February Cash Tracker continues to show the impact the Covid-19 pandemic is having on small businesses and the self-employed. Whilst cash deposits overall were flat month-on-month, business cash deposits were down 34% compared to February 2020.

Business cash deposits totalled £586 million last month. That compares to £582 million that was deposited in January. Post Office data indicates businesses have been better prepared for this third UK-wide lockdown compared with the first UK one in Spring last year when business deposits fell to £313 million in April. They totalled £345 million in May and £493 million in June before recovering over the summer.

In February, personal cash withdrawals amounted to £484 million. That was up 4.6% on January (£463 million). The amount withdrawn remains higher during this lockdown in comparison with the first UK-wide lockdown when cash withdrawals fell to £370 million in April 2020 and £450 million in May 2020.

Overall, cash deposits and withdrawals by personal and business customers amounted to £2.00 billion in February. This compares to £1.99 billion in January.

Commenting on February’s data, Martin Kearsley, Director of Banking at the Post Office, said:

“Business cash deposits in the first two months of the year have been consistent and continue to highlight the impact the Covid-19 lockdown is having on the UK’s small businesses and the self-employed who rely on Post Offices to deposit their takings.

“It’s encouraging that there was a small rise in personal cash withdrawals. We have remained open during this lockdown to support our local communities. 99% of our branches are open, many late into the evenings and at the weekend, providing a critical cash service for personal and business customers.”

Post Office Cash tracker data – February 2021

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for February 2021 | |

UK[1] | £1.50bn | -0.7% | -13.3% | £503m | +4.7% | -21.2% | £2.00bn |

England | £1.23bn | +0.2% | -10.2% | £391m | +4.4% | -22.5% | £1.62bn |

Scotland | £105.1m | -6.8% | -34.6% | £40.5m | +5.6% | -19.1% | £145.6m |

Wales | £75.6m | -3.9% | -18.9% | £42.7m | +3.9% | -18.8% | £118.3m |

Northern Ireland | £88.0m | -3.4% | -16.8% | £28.8m | +8.6% | -8.7% | £116.8m |

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; and bill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.