Press release -

Personal cash deposits up over 9% month-on-month; driven by energy voucher cash in Northern Ireland

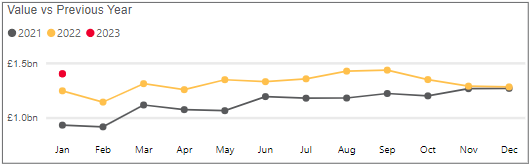

- Personal cash deposits at Post Offices totalled £1.4 billion, up 9.3% month-on-month (£1.28 billion, December 2022)

- In Northern Ireland, personal cash deposits totalled £204 million, up almost 100% month-on-month (£103 million, December 2022) and follows launch of £600 energy voucher scheme on 16 January for households that don’t pay for energy by direct debit

- Business cash deposits at Post Offices totalled £1.09 billion, the same amount that was deposited in December 2022

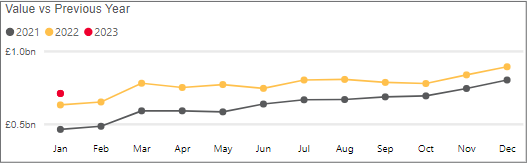

- Personal cash withdrawals totalled £709 million in January, down 20% month-on-month as the run-up to Christmas always sees increased amounts of cash withdrawn at Post Offices, but still up year on year

- In total, £3.2 billion in cash was deposited and withdrawn over the counter at Post Offices in January

New figures today reveal personal cash deposits at Post Offices totalled £1.4 billion in January, up over 9% compared with December.

The Post Office has attributed the increase to an almost 100% rise in cash deposits in Northern Ireland in January. On 16 January, the first of 500,000 £600 vouchers were issued by the Post Office to households who don’t pay for their energy by direct debit, on behalf of the Government.

A public awareness campaign was launched by the Post Officereminding people what identification they needed to bring in order to redeem their voucher.

Personal cash deposits in Northern Ireland totalled £204.3 million in January, compared with £103.1 million in December. Personal cash deposits in Northern Ireland on average are around £100 million a month.

On 7 February, just over three weeks since starting the voucher roll out, Post Office confirmed all 500,000 vouchers had been dispatched. Post Office expects cash deposits for February to also be significantly higher than a traditional month.

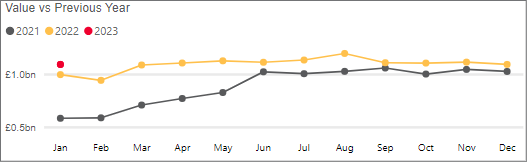

Business cash deposits at Post Offices totalled £1.09 billion in January, the same amount that was deposited in December.

Personal cash withdrawals totalled £709 million in January, down 20% month-on-month. Post Office attributes the fall to the traditional uplift in cash withdrawals seen at Post Offices in the run-up to Christmas.

In total, £3.2 billion in cash was deposited and withdrawn over the counter at Post Offices in January. This compares to £3.3 billion in December and £3.27 billion in November.

Martin Kearsley, Banking Director at Post Office, said:

“Billions of pounds worth of cash continues to be deposited every month at Post Offices. Postmasters are supporting local communities and businesses by keeping their branches open long hours and providing a convenient and secure location to deposit cash.

“In Northern Ireland, the ability of our 500 branches and our cash supply infrastructure to handle a 100% increase in cash deposits is a testament to the phenomenal hard work Postmasters and their teams have undertaken to support people claim their much needed £600 energy voucher.

“Our Banking Framework agreement means the vast majority of people have had the option to deposit their £600, or an amount of their choosing, straight into their bank account at the Post Office and avoid leaving a branch with a significant amount of cash. We expect a significant amount of cash to be deposited in February too and we expect cash deposits to remain higher than before the voucher scheme started as more and more people recognise they can do their everyday banking at Post Offices.”

Post Office Cash tracker data – January 2023

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for January 2023 | |

UK[1] | £2.49bn | +5.0% | +11.2% | £734.1m | -20.4% | +12.6% | £3.22bn |

England | £1.97bn | +1.2% | +6.9% | £574.1m | -19.6% | +13.4% | £2.55bn |

Scotland | £163.9m | -1.8% | +1.5% | £50.5m | -25.5% | +5.8% | £214.4m |

Wales | £119.5m | -2.4% | +6.8% | £58.0m | -21.1% | +8.5% | £177.5m |

Northern Ireland | £234.3m | +76.8% | +94.2% | £51.5m | -22.7% | +15.8% | £285.8m |

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.