Press release -

Personal cash withdrawals up 7% month-on-month in November

- Post Offices saw the highest amount of personal cash withdrawals all year in November.

- £878 million in cash was withdrawn from Post Offices 11,500 branches, up 7% month-on-month (£821 million, October 2023) and up 5% year-on-year (£836 million, November 2022).

- Personal and business cash deposits totalled £2.4 billion in November. This was down 1.9% month-on-month (£2.44 billion, October 2023) and flat year-on-year.

- In total, £3.3 billion in cash was deposited and withdrawn over the counter at Post Offices in November.

New figures today reveal Post Offices had their busiest month of the year for personal cash withdrawals in November.

Personal cash withdrawals across Post Office’s 11,500 branches totalled £878 million in November. Up 7% month-on-month (£821 million, October 2023) and up 5% year-on-year (£836 million, November 2022).

Personal cash deposits totalled £1.29 billion in November compared with £1.32 billion in October. Personal cash deposits were up slightly on last year (£1.27 billion, November 2022).

Business cash deposits totalled £1.11 billion in November compared with £1.12 bullion in October. Business cash deposits had also dipped compared with last year (£1.13 billion, November 2022).

In total, £3.3 billion in cash was deposited and withdrawn over the counter at Post Offices in November. This was almost identical to October (£3.3 billion).

Overall, the volume of cash deposit transactions was up over 450,000 year-on-year (+8.5%) indicating that businesses in particular are responding to bank-imposed cash limits by depositing smaller values but at higher volumes at their local Post Office. Post Offices continue to play a critical role in the survival of small businesses as they enter the Christmas period providing convenient and secure locations to deposit cash takings. A recent independent report by London Economics found that two out of five SMEs (39%) believe that the availability of cash and banking services at Post Offices is important.

Ross Borkett, Post Office Head of Banking, said:

“The increase in cash withdrawals last month coincide with other research which all indicates that some people are increasingly turning to cash in order to manage their budgets. Cash can be withdrawn over the counter, with no fees, at any of our 11,500 branches. Postmasters keep their branches open long hours, providing a convenient and secure location to withdraw cash to the penny that’s required.”

The over £3 billion worth of cash transactions at Post Office branches have been driven by continued bank branch closures, highlighting the importance of Post Offices within communities. Since 2015, a total of 5,632 banks and building societies have closed or are scheduled to close and over 500 bank branch closures have been announced for 2023 so far.

Post Office has partnerships with over 30 banks, building societies and credit unions meaning that 99% of UK bank customers can access their accounts at their Post Office branch.

Post Office Cash tracker data – November 2023

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for November 2023 | |

UK[1] | £2.40bn | -1.9% | -0.1% | £911m | +6.9% | +5.2% | £3.31bn |

England | £1.99bn | -2.1% | +0.0% | £713.5m | +7.0% | +5.6% | £2.70bn |

Scotland | £162.8m | -0.0% | -2.1% | £63.3m | +7.1% | +3.5% | £226.1m |

Wales | £122.6m | -2.6% | +1.9% | £71.1m | +6.1% | +3.9% | £193.7m |

Northern Ireland | £125.4m | +0.5% | -1.3% | £63.0m | +6.6% | +4.8% | £188.4m |

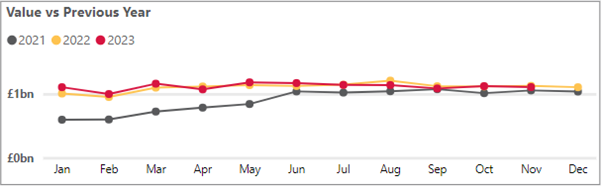

Business cash deposits

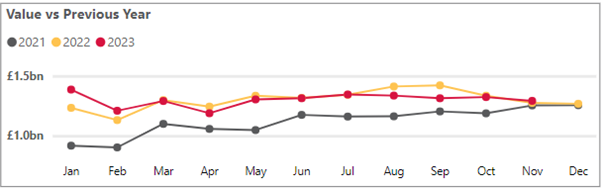

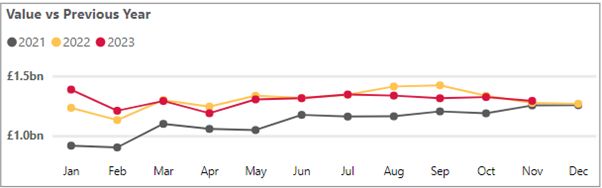

Personal cash deposits

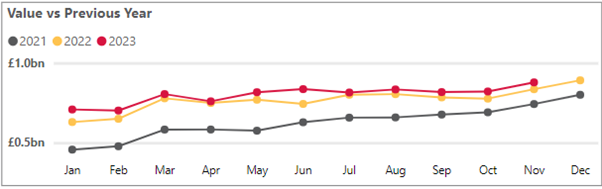

Personal cash withdrawals

Banking Hubs

As at 11th December, 32 hubs have been opened in partnership between Cash Access UK and the Post Office. Over 101 Banking Hubs have now been announced by LINK with further openings planned for the new year.

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; and; bill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.