Press release -

Post Offices see personal cash deposits up 5.5% year-on-year in March

- Post Offices saw personal cash deposits total £1.36 billion at its branches in March, up almost 5.5% year-on-year (£1.29 billion).

- In total, Post Offices handled £2.49 billion in personal and business cash deposits in March compared with £2.45 billion last March.

- Tenby Postmaster Vince Malone said: “We’ve had a recent revamp of the Post Office to offer enhanced banking to meet the needs of our community and tourists. We have a new high speed note counter that makes it quicker to process deposits.”

- Personal cash withdrawals from Post Office’s 11,500 branches totalled £840 million in March, up over 4% month-on-month (£806 million, February 2024).

New figures today (15 April) reveal Post Offices saw an almost 5.5% increase in personal cash deposits in March compared with the previous year.

In total, £1.36 billion worth of cash was deposited by personal customers in March compared with £1.29 billion in March 2023.

Business cash deposits totalled £1.13 billion in March which was up almost 6% month-on-month (£1.06 billion, February 2024), but a slight decrease on last year (£1.16 billion, March 2023).

Personal cash withdrawals over the counter at Post Office’s 11,500 branches totalled £840 million in March. This was up over 4% month-on-month (£806 million, February 2024) and up over 4% year-on-year (£805 million, March 2023).

In total, £3.36 billion worth of cash was deposited and withdrawn at Post Offices in March.

Tenby Post Office

Vince Malone has been the Postmaster for Tenby for a number of years. In partnership with Cash Access UK, the branch has become an Enhanced Banking Post Office after the location was chosen by LINK following an access to cash survey in the area.

Postmaster Vince Malone said:

“We are a small town of only 5,500 residents, but in the summer that number of people might be ten-fold with tourists and those working in the tourist industry.

“We’ve had a recent revamp of the Post Office to offer enhanced banking to meet the needs of our community and tourists. Our customers can very clearly see what banking services we can provide to help raise awareness and to help plug the town’s banking gap. We have a new high speed note counter that makes it quicker to process deposits.

“People in Tenby still like to use cash. Tourists find it easier to budget with cash, kids like to spend their pocket money. Many people working in tourism and hospitality are paid in cash and their earnings will vary depending upon the time of year and on the weather – if the weather is good they can earn more. Customers can make deposits on behalf of all the major high street banks, get balances and make cash withdrawals.”

Ross Borkett, Post Office Banking Director, said:

“Postmasters and their teams keep their branches open long hours enabling people to deposit or withdraw their cash conveniently and securely and they value face-to-face interaction when doing their everyday banking. March’s cash withdrawal and deposit figures suggests that a significant number of people and businesses continue to rely on being able to access their cash, for free, at their local Post Office in order to help with day-to-day management of their finances.”

Post Office has partnerships with over 30 banks, building societies and credit unions meaning that 99% of UK bank customers can access their accounts at their Post Office branch.

Post Office Cash tracker data – March 2024

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for March 2024 | |

UK[1] | £2.49bn | +5.9% | +1.5% | £871.6m | +4.3% | +4.3% | £3.36bn |

England | £2.07bn | +6.0% | +2.2% | £681.6m | +4.2% | +4.6% | £2.76bn |

Scotland | £165.7m | +6.5% | +0.7% | £61.3m | +4.3% | +5.1% | £226.9m |

Wales | £124.6m | +5.9% | +4.1% | £68.7m | +4.9% | +5.9% | £193.3m |

Northern Ireland | £122.7m | +4.5% | -10.9% | £60.0m | +4.7% | -1.1% | £182.7m |

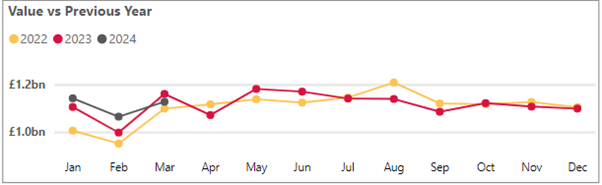

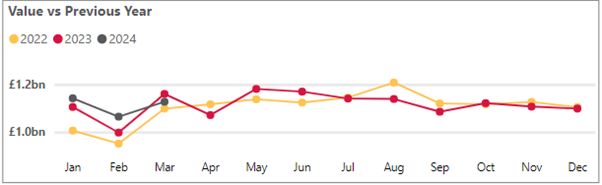

Business cash deposits

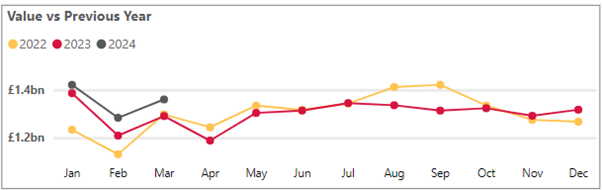

Personal cash deposits

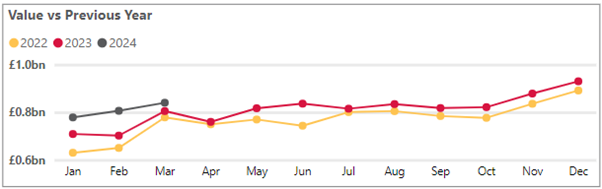

Personal cash withdrawals

Banking Hubs

As at 11 April, 46 hubs have been opened in partnership between Cash Access UK and the Post Office. 121 Banking Hubs have now been announced by LINK with further openings planned for later this year.

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

Ends

About Post Office Cash Tracker and access to cash

Data included in this press release reflects cash services used under the Banking Framework. Over 30 banks and building societies are part of the Banking Framework which enables their customers to withdraw or deposit cash at any of the Post Office’s 11,500 branches. The figures exclude Post Office Card Account withdrawals. On 31 January 2022, Post Office announced that the Banking Framework agreement has been extended until the end of 2025.

About Banking Hubs

Banking Hubs are modern, shared spaces developed in partnership with Cash Access UK where Post Office provides everyday banking and cash services to local residents and businesses, and high street banks can provide their customers with financial advice and other services from one of their community bankers in a dedicated room.

The hubs are operated by Post Office and intended for communities whose access to cash has been restricted as a result of bank branch closures. The status of banking hubs and whether they are open or still under construction can be seen at this link - Cash Access UK - Hubs

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; and; bill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.