Press release -

Rail strikes, freezing weather and bank deposit limits see fall in cash deposits at Post Offices

- Impact of December’s rail strikes, freezing weather and stricter bank deposit limits sees fall in business cash deposits at Post Offices

- Post Offices handled £1.09 billion in business cash deposits in December, down 2% month-on-month (£1.11 billion, November 2022)

- Personal cash withdrawals continued to increase with £892 million withdrawn over the counter, up 6.7% month-on-month (£836 million, November 2022) and up over 11% on December 2021 (£801 million)

- In total, Post Offices handled £3.3 billion in cash deposits and withdrawals in December

- Post Office urges Government to ensure forthcoming Financial Services and Markets Bill enshrines the whole cash cycle with people and businesses able to easily deposit cash locally, securely and conveniently

New figures today reveal a fall in business cash deposits at Post Offices in December, attributed to last month’s rail strikes, freezing weather and on-going bank deposit limits impacting the hospitality sector.

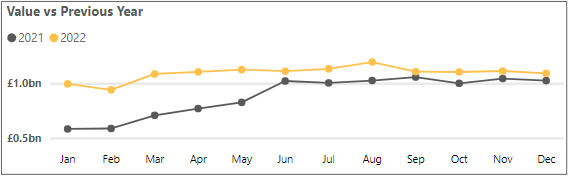

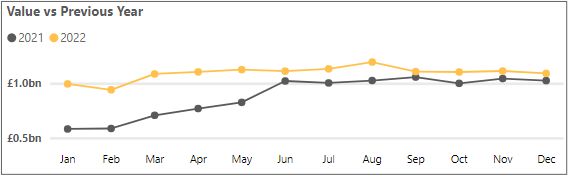

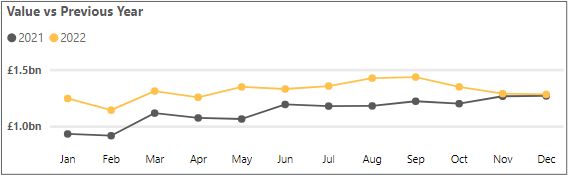

Business cash deposits totalled £1.09 billion in December, a fall of 2% month-on-month (£1.11 billion, November 2022). This is down on the record £1.2 billion worth of business cash deposits set in August 2022.

Post Office has also attributed the fall in business cash deposits to newly introduced deposit limits that some banks have set as part of a tightening of money laundering controls. This has resulted in limits on the amount of cash that some customers can deposit over the counter at Post Offices. The recent introduction of these limits has already started to impact thousands of legitimate small and independent businesses and risks undermining legislation being debated in Parliament to protect Access to Cash by making it hard for those businesses to then pay their cash back in.

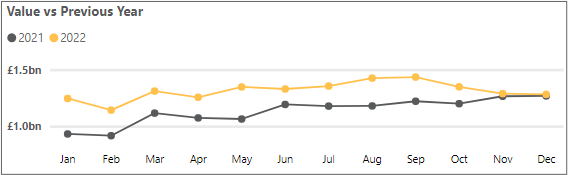

Personal cash deposits totalled £1.28 billion in December, dipping 0.5% month-on-month (£1.29 billion, November 2022). In total, Post Offices handled £2.37 billion worth of deposits in December, down 1.2% month-on-month (£2.40 billion, November 2022).

Martin Kearsley, Banking Director at Post Office, said:

“December was a torrid month for the hospitality sector amongst others, with strikes and freezing weather reducing footfall and cash takings across pubs, cafes and restaurants especially; and in turn contributing to a fall in deposits at Post Offices. Small businesses are the backbone of the British economy. Over-zealous limits imposed on the amount they are able to deposit is resulting in more businesses no longer being able to accept cash, impacting both their ability to trade as they would like, as well as their customers who need or choose to budget using cash. They must remain able to deposit their takings locally, securely and conveniently without having to suspend or disrupt trading to make an ever longer journey to a distant bank branch to deposit their takings.”

Personal cash withdrawals

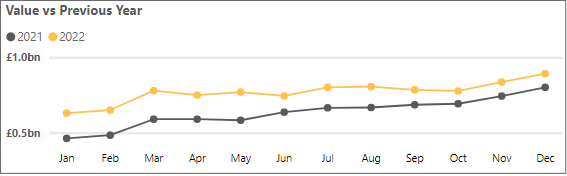

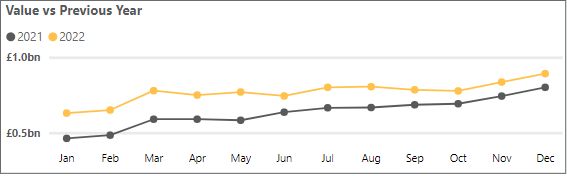

Personal cash withdrawals totalled a record £892 million in December. This was up 6.7% month-on-month (£836 million, November 2022) and up 11% on December 2021 (£801 million).

The increase in personal cash withdrawals coincides with the Post Office’s renewed partnership with the Trussell Trust. Since November last year, Post Office has been donating 1p from every cash withdrawal and hopes to raise £330,000 for the charity over the winter. In addition, Post Offices are also providing energy relief payments, winter fuel payments and cost of living payments in cash on behalf of the Government and local councils to vulnerable people.

Martin Kearsley added:

“Millions of people continue to visit their local Post Office to withdraw cash in order to budget and Postmasters are playing a vital role in helping people, particularly those on low incomes, navigate this Winter. In addition to cash deposit and withdrawal services, Postmasters are processing tens of thousands of Energy Bill Support Scheme vouchers for prepaid meter customers every week.”

In 2022, £38.4 billion worth of cash was deposited and withdrawn over the counter at Post Office’s 11,500 branches. This compares to £32.1 billion in 2021.

Post Office Cash tracker data – December 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for December 2022 | |

UK[1] | £2.37bn | -1.2% | +3.5% | £922.2m | +6.6% | +11.4% | £3.29bn |

England | £1.95bn | -1.8% | +4.4% | £715m | +5.7% | +11.7% | £2.66bn |

Scotland | £166.8m | +0.1% | -3.2% | £67.8m | +10.8% | +6.2% | £234.6m |

Wales | £122.4m | +1.7% | +2.4% | £73.6m | +7.6% | +8.5% | £196.0m |

Northern Ireland | £132.6m | +4,4% | +0.8% | £66.6m | +10.9% | +17.1% | £199.1m |

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

Ends

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.