Press release -

Record £801 million in cash is withdrawn at Post Office counters over festive period

- £801 million in personal cash withdrawals took place over the counter at Post Office’s 11,500 branches in December. Up 7.8% on November (£743 million)

- Record cash withdrawal figure coincided with start of Post Office’s £250,000 charity partnership with Trussell Trust where 1p from every cash withdrawal is donated to the charity

- Post Offices handled record £3.1 billion in cash deposits and withdrawals in December, up on previous £3 billion November record despite Covid-19 restrictions introduced in parts of the UK over the festive period

- Personal cash deposits grew 0.2% month-on-month (£1.26 billion, December 2021)

- Business cash deposits dipped 1.8% month-on-month (£1.02 billion, December 2021) as hospitality and leisure sectors implemented Covid-19 restrictions, reducing cash intake

- Post Offices provided lifeline for small businesses, pubs, restaurants and cafes able to trade throughout December by staying open long hours offering convenient location to deposit cash takings

Over £800 million in cash was withdrawn by personal customers over the counter at Post Offices during the festive period.

The record figure was up 7.8% on November (£743 million) and 25% up on December 2020 (£640 million). It comes as the Post Office launched a new charity partnership with the Trussell Trust where 1p from every cash withdrawal over the counter is donated to the charity. Post Office hopes to raise £250,000 between now and the end of February.

Overall, Post Offices handled a record £3.1 billion in cash deposits and withdrawals in December, up on the previous £3 billion November record. In December 2020, Post Offices handled £2.4 billion.

The record figure for December 2021 came despite Covid-19 restrictions being introduced over the festive period in parts of the UK that meant businesses reliant on cash had reduced takings and therefore in some cases reduced cash deposits at their local Post Office. Business cash deposits dipped 1.8% month-on-month (£1.02 billion, December 2021).

Personal cash deposits grew 0.2% month-on-month (£1.26 billion, December 2021). Personal and business cash deposits were both up 30% year-on-year.

Martin Kearsley, Banking Director at Post Office, said:

“Postmasters kept their Post Offices open throughout the festive period serving their communities and providing a convenient and secure location for millions of people and businesses to do their everyday banking. Despite Covid-19 restrictions being introduced and some people’s natural desire to avoid going out to see friends and family before Christmas, it’s testament to the hard work of Postmasters that a record £3.1 billion was processed at branches.”

“We are incredibly proud of our partnership with the Trussell Trust and are heartened that customers withdrew a record £801 million over the counter, helping us to raise vital funds for the charity at this challenging time of year for so many families.”

On 30 November, the Post Office announced a new charity partnership with the Trussell Trust and is donating 1p for every cash withdrawal done over the counter. Post Office hopes to raise £250,000 for the charity. Post Office customers have helped raise a third of its target in December alone.

More than 14m people in the UK live in poverty, including 4.5m children and for many of these people, the cost of living is unaffordable. At a time when energy prices are rising and supply chains are under increased pressure, for some, an unexpected illness or job loss can turn a bad situation into a financial crisis. The Trussell Trust supports a nationwide network of over 1,300 food bank centres and together they provide emergency food parcels to people locked into poverty and campaign for change to end the need for food banks in the UK.

Post Office Cash tracker data – December 2021

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for December 2021 | |

UK[1] | £2.29bn | -0.7% | +29.8% | £828m | +7.6% | +24.6% | £3.12bn |

England | £1.87bn | -1.3% | +32.2% | £639.8m | +6.6% | +23.4% | £2.5bn |

Scotland | £172.1m | +0.8% | +17.0% | £63.7m | +10.9% | +17.5% | £235.7m |

Wales | £119.5m | +0.3% | +25.7% | £67.8m | +9.5% | +23.3% | £187.3m |

Northern Ireland | £131.5m | +5.7% | +19.5% | £56.8m | +14.6% | +53.5% | 188.3m |

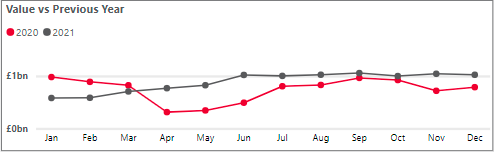

Business cash deposits

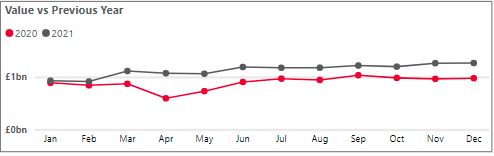

Personal cash deposits

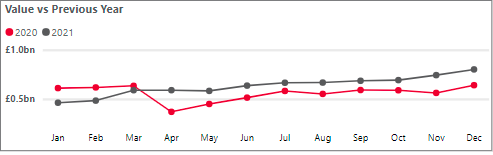

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.