Press release -

Record amount withdrawn at Post Offices in July – up 14% year-on-year as consumers continue to spend their cash

- A record £665 million in personal cash withdrawals took place at Post Office counters in July, up 14.3% on July 2020 (£582 million).

- Cash withdrawals in July were the highest for any month recorded at the Post Office excluding the traditionally busy December period.

- Total value of cash deposits at Post Offices totalled £2.18 billion, similar to the previous month (£2.21 billion, June 2021)

- Business cash deposits exceeded £1 billion for second month in a row

- Personal cash deposits exceeded £1 billion for the fifth month in a row

- Post Offices are providing critical cash services to people and businesses that use it to budget, save and survive. As part of its ‘Save Our Cash’ campaign, Post Office has called on Government to speed up the delivery of the necessary legislative and regulatory frameworks which must underpin the long-term future of the cash system.

Post Office saw the highest ever amount of cash withdrawn from its 11,500 branches outside of the traditionally busy December period, according to the latest date from its Cash Tracker.

In total, £2.87 billion was deposited and withdrawn in cash in July, identical to the amount in June (also £2.87 billion). Business cash deposits exceeded £1 billion for the second month in a row and personal cash deposits exceeded £1 billion for the fifth month in a row. Both saw slight dips compared with June. However, personal cash withdrawals were up 4.6% month on month which resulted in cash deposits and withdrawals being identical month-on-month.

Cash withdrawals

Personal cash withdrawals in July 2021 totalled £665 million. This was the highest amount withdrawn at Post Office counters excluding the traditionally busy December period. Cash withdrawals in July did exceed December 2020 (£641 million). However, the highest amount ever withdrawn at Post Office counters was £707 million in December 2019.

Personal cash withdrawals in July were up 4.6% month-on-month and up 14.3% year-on-year indicating that consumers are continuing to spend cash on retail and hospitality as the country continues to unlock from the Covid-19 pandemic.

Cash deposits

Business cash deposits exceeded £1 billion for the second month in a row. This was the first time since October 2019 that cash deposits had exceeded £1 billion for two consecutive months. Business cash deposits totalled £1.00 billion in July 2021, which was down just 1.7% month-on-month (£1.02 billion, June 2021).

A Post Office survey of more than 500 UK small businesses last month revealed that two thirds (66%) feel that the continued use of cash is important to the recovery of the UK retail industry post-lockdown. Nearly 1 in 5 (18%) said that they depended on their local Post Office branch for cash and banking services.

Personal cash deposits exceeded a billion pounds for the fifth successive month. In July, £1.18 billion was deposited over the counters, which was down just 1.2% month-on-month (£1.19 billion in June).

Martin Kearsley, Banking Director at Post Office, said:

“Our Postmasters are providing increased support to their local communities with a convenient and secure way to withdraw cash. As some banks continue to close branches, either permanently or in response to staff shortages during the pandemic, Post Offices are ‘the last counter in town’ in many places across the country.

“More than £665 million was withdrawn in a single month and this cash is predominantly being spent in local businesses, cafes and pubs on the High Street. Post Offices will continue to play a key role in local communities’ cash eco-system up and down the country. Many branches are also open late in the evening and at weekends, providing local businesses with a convenient location to deposit much needed takings and in turn serve their own customers longer too.”

Post Office Cash tracker data – July 2021

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for July 2021 | |

UK[1] | £2.18bn | -1.5% | +22.8% | £690.6m | +4.5% | +13.7% | £2.87bn |

England | £1.79bn | -1.3% | +23.1% | £540.3m | +5.0% | +12.8% | £2.33bn |

Scotland | £163.9m | -2.5% | +29.1% | £53.3m | +3.1% | +11.9% | £217m |

Wales | £113.9m | -0.5% | +25.6% | £57.1m | +3.3% | +15.1% | £171m |

Northern Ireland | £111.4m | -2.8% | +9.5% | £39.9m | +2.9% | +28.2% | £151m |

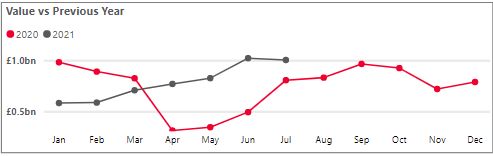

Business cash deposits

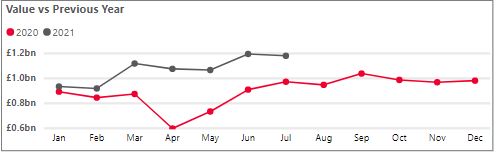

Personal cash deposits

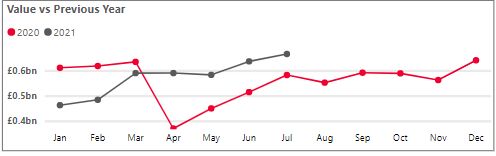

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

Ends

About Post Office Cash Tracker and access to cash

Data included in this press release reflects cash services used under the Banking Framework. Over 30 banks and building societies are part of the Banking Framework which enables their customers to withdraw or deposit cash at any of the Post Office’s 11,500 branches. The figures exclude Post Office Card Account withdrawals.

Post Office is running its ‘Save our Cash’ campaign. At www.SaveOurCash.co.uk, visitors can hear the real stories of people reliant on cash and learn more about how cash plays such a pivotal role in their lives. Post Office is calling on as many people as possible to write to their MP to support policies and legislation that protect cash and place an obligation on the banks to guarantee access to cash across the UK.

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.