Press release -

Record cash withdrawals and deposits in August before dip in September cash withdrawals with additional Bank Holiday for Her Majesty The Queen’s state funeral

- Post Offices handled record-breaking amounts of cash in August (£3.45bn), the first time the amount exceeded £3.4bn in one month

- Personal cash withdrawals in August totalled £805 million, up 0.5% on July, the previous record month (£801 million)

- Personal cash deposits exceeded £1.4 billion for the first time and business cash deposits were up 5.5% on July, almost reaching £1.2 billion

- Cash deposits and withdrawals in September had been expected to again reach record levels, before the Bank Holiday for the state funeral of Her Majesty The Queen on Monday 19 September

- Cash deposits and withdrawals on Monday 19 September were down 94% (£150 million) on the equivalent Monday in September 2021

- In September, Post Offices handled £3.35 billion in cash deposits and withdrawals at its 11,500 branches compared with £3.45 billion in August

New figures today reveal Post Office continued to handle record amounts of cash in August, despite the fact it is traditionally a quieter month for cash transactions at its branches.

Cash transactions in September had initially been on track to hit even higher levels at Post Office’s 11,500 branches, however the additional bank holiday on Monday 19 September for the state funeral of Her Majesty The Queen saw cash transactions down 94% compared with the equivalent Monday in September 2021 and resulted in an overall dip in cash withdrawals and business cash deposits last month.

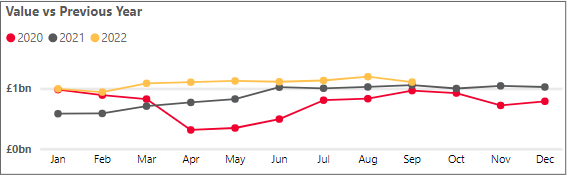

In August, £3.45 billion in cash deposits and withdrawals were handled at Post Offices. This was the first time the amount had exceeded £3.4 billion in a month and was up almost £140 million month-on-month (£3.32 billion, July 22). In September, £3.35 billion in cash deposits and withdrawals were handled at Post Offices.

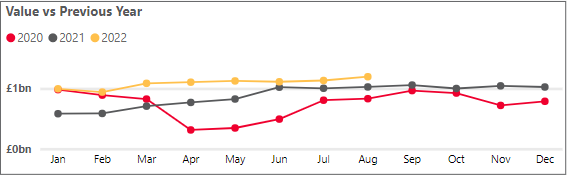

Cash withdrawals

A record £805 million in personal cash withdrawals took place in August, up 0.5% and breaking the previous record set in July when £801 million in cash was withdrawn. Cash withdrawals were up almost 21% on August 2021 (£667 million).

In September, cash withdrawals totalled £785 million, a dip of 2.5% month-on-month.

Post Office attributes the continuing high levels of cash withdrawals to the on-going closure of local bank branches*, with people turning to the Post Office to support them with their cash needs. As the cost of living begins to bite, people are also increasingly turning to cash to manage their budget on a week-by-week basis and often day-by-day.

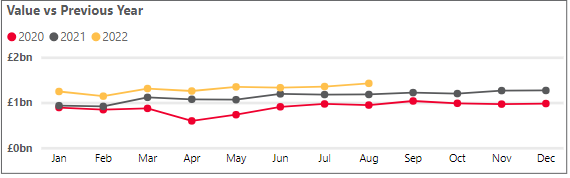

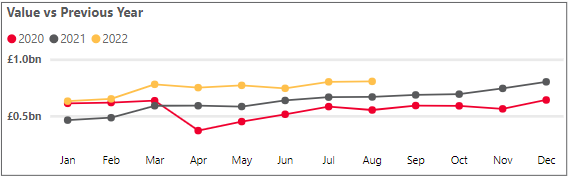

Cash deposits

In August, personal cash deposits exceeded £1.4 billion for the first time, up 5% month-on-month (£1.35 billion, July 22) and business cash deposits almost reached £1.2 billion, up 5.5% month-on-month (£1.13 billion, July 22).

In September, despite the unexpected Bank Holiday, personal cash deposits were still up 0.6% on August with £1.43 billion deposited by personal customers. Business cash deposits totalled £1.11 billion, down 7.3% month-on-month.

Bank Holiday – Monday 19 September

Cash deposits and withdrawals in September had been expected to again reach record levels before the Bank Holiday for the state funeral of Her Majesty The Queen on Monday 19 September.

On Monday 19 September, £10 million was withdrawn and deposited at the limited number of Post Offices that were open on that day. That was down 94% (£150 million) compared with the equivalent Monday in September 2021 when £160 million was deposited and withdrawn at Post Offices.

Martin Kearsley, Banking Director at Post Office, said:

“Despite August traditionally being a quieter month for cash transactions, that’s not what we saw at our 11,500 branches. Millions of people are continuing to come into their local Post Office every week and rely on Postmasters and their colleagues as the only ones able to fulfil all the cash needs of their local communities and businesses with many branches open seven days a week.

“The vast majority of Post Offices quite rightly remained closed on the day of Her Majesty The Queen’s state funeral as the whole country came together to mourn Her Majesty and reflect on her legacy. This did, of course, result in a dip in cash withdrawals and deposits by business customers given many retailers and businesses were also closed. We expect cash transactions to continue to exceed expectations in October and for the rest of the year.”

Last month it was announced that an additional 13 banking hubs would be created, bringing the total (including the two pilot sites and the 10 areas previously identified) to 25. The hubs are shared spaces operated by Post Office and intended for communities whose access to cash has been restricted as a result of bank branch closures.

Post Office already operates the two pilot hubs in Rochford and Cambuslang and will also be operating the additional 13.

Martin Kearsley added:

“We’re delighted that we will be operating all of the banking hubs across the country that have so far been announced. Post Offices already handle well over £3 billion worth of cash every month and we’re increasingly seen as the only place on the High Street where everyday banking can be done. We’re looking forward to working closely with the Banking Hub Company and participating banks so that these hubs can be opened and start fulfilling people’s banking needs as soon as possible.”

Post Office Cash tracker data – August 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for August 2022 | |

UK[1] | £2.62bn | +5.3% | +18.8% | £832.7m | +0.5% | +20.5% | £3.45bn |

England | £2.15bn | +4.5% | +19.3% | £645.1m | -0.2% | +19.6% | £2.80bn |

Scotland | £196.5m | +11.2% | +14.2% | £60.9m | +1.4% | +14.6% | £257.4m |

Wales | £136.7m | +7.7% | +16.3% | £68.7m | +2.5% | +20.1% | £205.4m |

Northern Ireland | £133.4m | +8.2% | +20.6% | £58.0m | +4.7% | +39.1% | £191.4m |

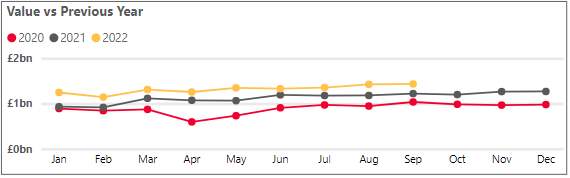

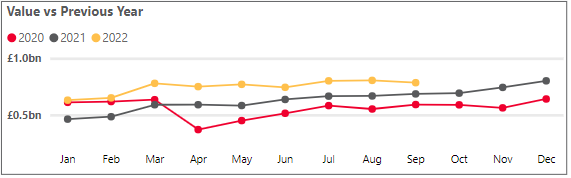

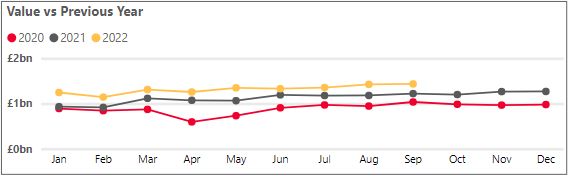

Business cash deposits

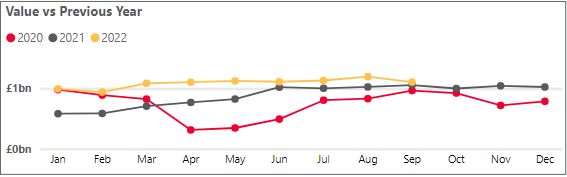

Personal cash deposits

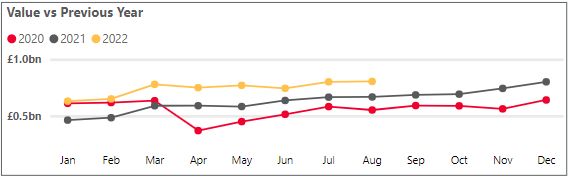

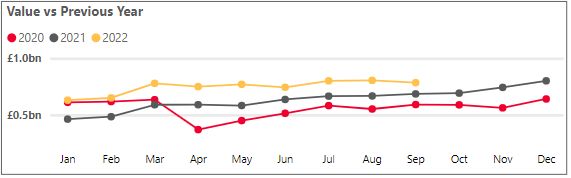

Personal cash withdrawals

Post Office Cash tracker data – September 2022

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for September 2022 | |

UK[2] | £2.54bn | -3.0% | +11.6% | £812.3m | -2.4% | +14.3% | £3.35bn |

England | £2.10bn | -2.7% | +11.8% | £633.3m | -1.8% | +13.8% | £2.73bn |

Scotland | £182.3m | -7.1% | +7.4% | £58.5m | -4.0% | +10.0% | £241m |

Wales | £130.0m | -4.9% | +10.2% | £65.0m | -5.4% | +12.4% | £195m |

Northern Ireland | £133.7m | +0.3% | +16.4% | £56.0m | -3.5% | +29.3% | £190m |

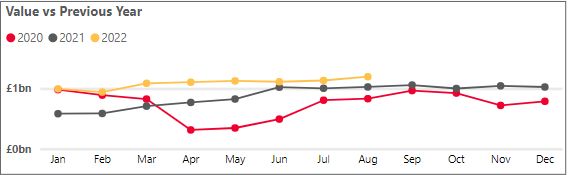

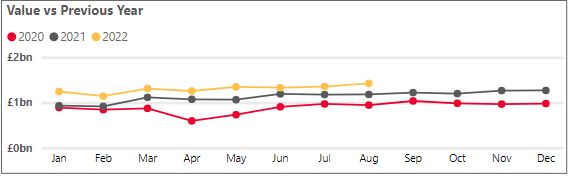

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

Ends

About Post Office Cash Tracker and access to cash

Data included in this press release reflects cash services used under the Banking Framework. Over 30 banks and building societies are part of the Banking Framework which enables their customers to withdraw or deposit cash at any of the Post Office’s 11,500 branches. The figures exclude Post Office Card Account withdrawals. On 31 January 2022, Post Office announced that the Banking Framework agreement has been extended until the end of 2025.

Post Office is running its ‘Save our Cash’ campaign. At www.SaveOurCash.co.uk, visitors can hear the real stories of people reliant on cash and learn more about how cash plays such a pivotal role in their lives. Post Office is calling on as many people as possible to write to their MP to support policies and legislation that protect cash and place an obligation on the banks to guarantee access to cash across the UK.

About Bank Hubs

Banking Hubs are modern, shared spaces where Post Office provides everyday banking and cash services to local residents and businesses, and high street banks can provide their customers with financial advice and other services from one of their community banker’s in a dedicated room

The hubs are operated by Post Office and intended for communities whose access to cash has been restricted as a result of bank branch closures.

Among the 13 new proposed banking hub sites, four are in Scotland and, for the first time, one is in Northern Ireland, in Kilkeel.

They will be in Brechin in Angus, Forres in Moray, Carluke in Lanarkshire, Kirkcudbright in Dumfries and Galloway, Axminster in Devon, Barton-upon-Humber in Lincolnshire, Lutterworth in Leicestershire, Royal Wootton Bassett in Wiltshire, Cheadle in Staffordshire, Belper in Derbyshire, Maryport in Cumbria, Hornsea in Yorkshire, and also in Kilkeel.

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

[2] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.