Remaining households in Northern Ireland urged to redeem £600 household energy voucher, warns Post Office

Post Office is urging the approximately 20,000 households (around 4%) who have not yet redeemed their £600 energy vouchers to do so

Post Office is urging the approximately 20,000 households (around 4%) who have not yet redeemed their £600 energy vouchers to do so

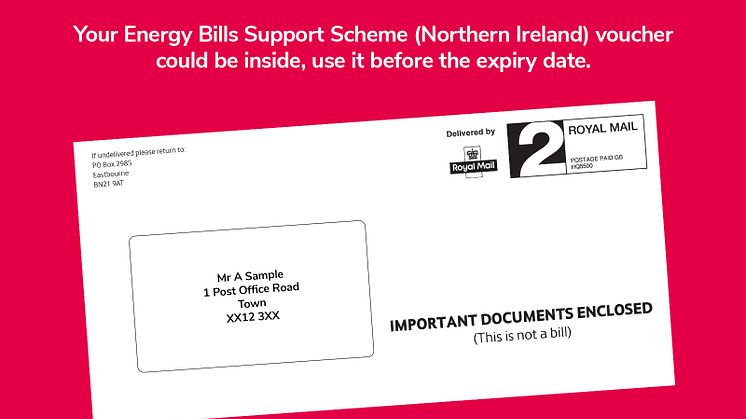

The Post Office confirms that all 500,000 energy vouchers, issued on behalf of the Government to households in Northern Ireland, have now been dispatched.

Over half of energy vouchers, issued on behalf of the Government to households in Northern Ireland, have now been redeemed according to Post Office data.

The first £600 energy vouchers from the Government for households in Northern Ireland have started arriving through letterboxes

Post Office branches in Great Britain have already processed nearly three million Energy Bill Support Scheme (EBSS) vouchers to help people claim the £400 government energy discount.

Commenting on the UK Government’s announcement that people in Northern Ireland will receive a £600 Energy Bills Support Scheme and Alternative Fuel Payment from mid-January, Nick Read, Chief Executive at the Post Office, said:

“Our 500 Post Offices across Northern Ireland are at the heart of their communities and Postmasters are preparing for the vital role they will play in getting people the

Post Office is urging the UK Government, local councils and energy companies to make use of its ‘Payout’ voucher service that enables customers to redeem Warm Home Discounts or receive other cash grants at their local branch.

Two-thirds of UK consumers are concerned about increased energy prices finds a new Post Office poll.

Nationwide, the average time it takes to sell a home has increased by nearly two weeks in the last year, to 114 days Homes in Oxford, one of the least affordable cities in the UK, take the longest to sell, staying on the market for an average of nearly five months (152 days) Aberdeen is the second slowest-selling city (151 days), despite Scotland’s quick legal process which helped Edinburgh and

Parents set to spend £624 entertaining their children this summer – a total of £9.1 billion across the UK Parents who have put away money in advance of the holidays underestimate the cost of summer by £373 Two out of three (65%) parents worry about covering the costs of summer One in five parents (21%) will dip into their existing savings and one in 10 (10%) will take out a loan to fund summ

Post Office and CEBR reveal potential savings opportunity of £5,950 per household*

• Riga remains the lowest priced city for a Christmas Markets break - 44 per cent cheaper than Copenhagen, the most expensive of 10 surveyed in Europe • Designer goods cost less in five of the European cities surveyed than in London – Lille offers the biggest savings of over 13 per cent for 10 top gift items while individual items can cost as much as 48 per cent less

The number of over 65s in work has doubled since records began – as half (46%) now believe modern retirement is about redefining how work fits into your life Only a third of over 65s now survive on the state pension alone (31%) – with one in ten (11%) seeing remortgaging, loans and equity release as sensible options to borrow money One in five workers of pensionable age (18%) have already retir

Nearly seven out of 10 people aged over 50 (68%) say the traditional concept of retirement is no more – as they reveal their midlife motivations and ambitions

‘Midlife Tribes’ emerging in our changing society include ‘Elderpreneurs’, ‘Fitness Finders ’ and ‘New Horizonians’ with adventure, community and romance as top priorities for many as they embark on the next chapter of their lives

Post Office reveals what the value of sterling means for holidaymakers

Sterling now stronger year-on-year against 80 per cent of holiday currencies

Biggest gains of up to 16.7 per cent against long haul currencies

‘Dollar destinations’ – USA, Caribbean and Middle Eastern resorts – are 11.5-12 per cent weaker against sterling and down five per cent in the past three months

Position is

A quarter make impulse purchases on social media on a monthly basis, spending an average of £318 per user per year 65% had regrets about their purchases One in seven confess to ‘financial upgrading’ – buying something more expensive than they had planned Despite this, nearly half say social media has no impact upon their spending habits More than half fell short of their

Post Office Holiday Money Report identifies destinations where the holiday purse will stretch furthest in 2018 (www.postoffice.co.uk/holidaymoneyreport) • Sunny Beach, Bulgaria tops chart of 42 destinations for the first time • Japan is runner up and cheapest for long haul holidaymakers • Cape Town, South Africa and Porec, Croatia enter best value top 10

• Prices drop in two-thirds of European family ski resorts surveyed by Post Office Travel Money and Crystal Ski Holidays (www.postoffice.co.uk/familyskiing) • Bansko has regained its position as the cheapest family ski resort • Bardonecchia is best value in Western Europe – almost half the cost in Wengen

The House Price Index, June 2017, revealed that average house prices in the UK have increased by 4.9% in the year to June 2017 (down from 5.0% in the year to May 2017). The annual growth rate has slowed since mid-2016 but has remained broadly around 5% during 2017. Owen Woodley, Managing Director of Post Office Money, said:

“A slower rate of house price growth will no doubt be welcomed by first

New Post Office Money research shows FTBs travelling to new areas to find the home for them Southampton, Norwich and Nottingham are the UK’s most affordable cities for FTBs Despite nerves and financial pressure, FTBs still see home-buying as an exciting and joyful step towards independence Futurologists’ insights can help identify potential hotspots of tomorrow