Press release -

Post Office expands its Digital Identity services offering in new partnership with Yoti

- Partnership combines Post Office’s experience in identity services and extensive branch network with Yoti’s leading identity technology to play key role in driving UK’s digital transformation

- Post Office already market leader for providing digital identity solutions to access Government services

- Partnership with Yoti now sees Post Office expand its identity services, launching a new free-to-use Post Office App for customers and in-branch services that gives people a choice as to how they prove or confirm their identity, enabling them to simply, safely and securely transact online and in person.

- Demonstration of Post Office strategy to embrace new technology, with ambition to deliver a unique offering that integrates digital and physical identity verification at scale, helping to reduce UK fraud.

- Partnership secures new, additional revenue for Postmasters who continue to provide trusted and reassuring face-to-face advice and services for millions of customers each week

Post Office is expanding its presence in the identity services market with the roll-out of a suite of online and in-branch products in a new partnership with digital identity company Yoti. The rollout includes a free-to use app that will combine customers’ personal data and biometrics to create a secure, reusable ID on their phone, and in-branch services for those customers who do not have access to a smartphone or who prefer face-to-face contact when asked to confirm their identity.

The partnership will also connect Post Office customers with online businesses, by enabling companies to use Post Office and Yoti identity verification services for fraud detection, E-signatures and customer authentication services, using secure biometric face matching and liveness detection.

The partnership combines Post Office’s existing experience in identity services and its extensive branch network with Yoti’s leading identity technology to help drive the UK’s digital transformation. Post Office continues to embrace new technology and this further expansion into the identity services market is part of its efforts to adapt and remain relevant in the digital age, whilst ensuring it continues to offer customers choice as to how they transact.

The UK’s digital identity market is currently worth an estimated £2 - 4 billion per annum and growing at 5% each year* as regulation and digitisation grows. As UK companies, Government departments and public sector organisations continue to embrace digital transformation, difficulties with asserting identity in a digital world can fuel uncertainty and lack of trust that limits the full range of services offered online.

Nick Read, Chief Executive at Post Office, said:

“Post Office is embracing new technologies and this partnership will enhance our reputation as the trusted go-to destination for identity solutions. Whether it’s proving your identity on a smartphone or face-to-face with a Postmaster, we will make transactions faster and simpler than ever before.”

“I am delighted that Post Office and Yoti are joining forces to expand our identity services. We have an ambitious strategy to deliver a unique offer to the market that integrates digital and physical identity verification at scale benefitting both individuals and businesses.”

Robin Tombs, CEO at Yoti, said:

“I’m proud to announce Yoti’s partnership with the Post Office, together we’ll make it simpler and safer to prove who you are and know who you’re dealing with, anywhere in the UK. Seven years ago, Yoti set out to fix the broken identity system. Trust is critical in the emerging digital ID space and our plan has always been to partner with the Post Office, which I believe is one of the most trusted brands in the UK.

“We have already invested over £85m creating a world-leading ID platform that removes the friction from outdated ID processes, puts individuals in control of their identity, preserves privacy and helps reduce identity fraud. Together with the Post Office, we will help drive the UK’s digital transformation, making life simpler and safer for individuals and businesses online, in-branch and on the high street.”

Post Office and Yoti have ambitions to be the UK market leader in identity services, providing solutions that will enable individuals and businesses to be able to trust that others are who they claim to be in every online and face-to-face transaction.

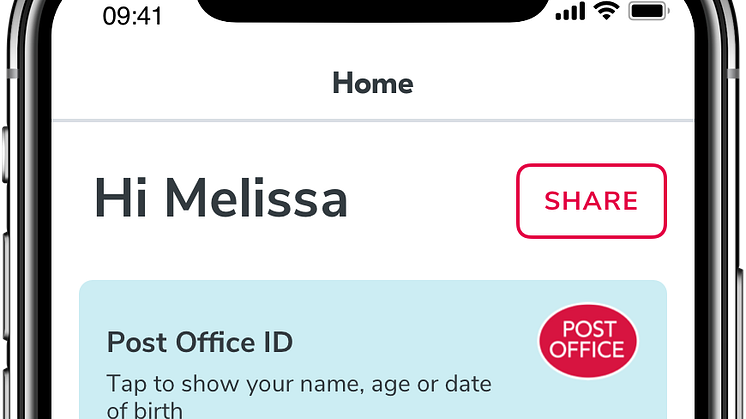

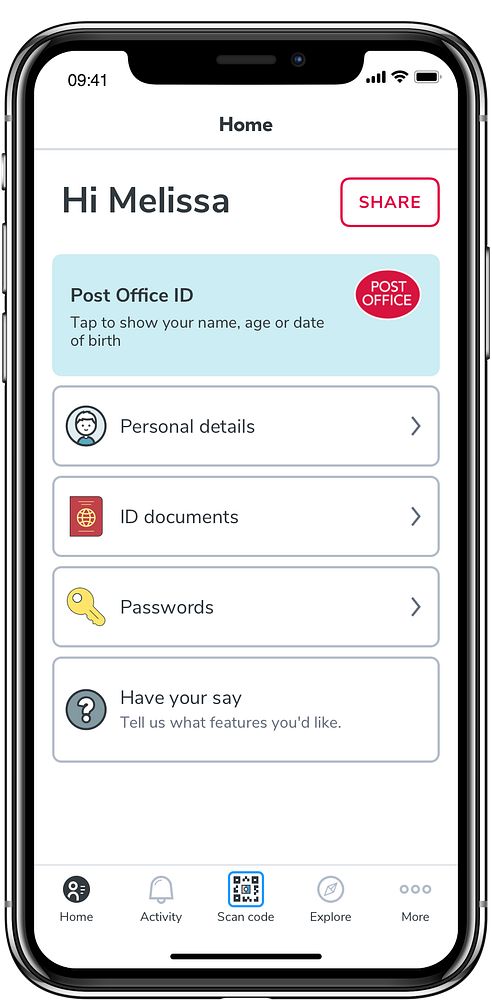

Post Office Digital Identity App

A new free-to-use Post Office digital identity App will launch in the Spring. It will combine a person’s personal data and biometrics to create a secure, reusable ID on their device.

Customers have the choice as to what information they share. The creation of their own digital identity means they don’t need to carry documents such as a driver’s licence or passport to prove their identity. Customers will be able to use the Post Office digital identity app for a range of online and in person transactions such as one-click bank account applications, job applications, mortgage applications, proof of age for the purchase of restricted goods such as cigarettes, picking up parcels and for travel purposes.

Customer products and services in-branch

Post Office is the market leader for enabling people to verify their identity online and access Gov.UK Verify Services such as tax self-assessment, Universal Credit and basic Disclosure and Barring Service (DBS) checks. Almost four million UK citizens hold a Post Office Gov.UK Verify account.

Post Office also provides a number of identity transactions such as passport and driving licence renewals as well as DBS and documentation certification checks from its branches. In 2020, despite Covid-19 related lockdown restrictions, seven million identity-related transactions were carried out at Post Office branches.

As part of this partnership with Yoti in July, a pilot, initially at around 750 Post Offices, will offer these new in-branch services. This will enable those people without a smartphone, secure internet access, or photo ID to complete their identity verification at a Post Office. Those who simply prefer face-to-face transactions will also be able to have their identity verified by a Postmaster in-branch.

Business to Business products and services

Post Office and Yoti will bring a range of reusable and transactional identity services to businesses. These include identity verification services which can be used as part of fraud detection measures, age verification services, E-signature services and customer authentication services which provide customers with a secure way of accessing a company’s services using secure biometric face matching and liveness detection.

Elinor Hull, Identity Services Director at Post Office, said:

“Access to products and services are increasingly moving online, whether it’s opening a bank account, applying for a job, accessing medical services or buying goods. We’re responding to this shift with a free-to-use App that will allow customers to build their own secure digital identity on their smartphone, enabling them to easily control and prove who they are to whichever business they want to interact with. For businesses, we are providing a suite of transactional and reusable identity verification services that will enable them to serve their customers with ease, trust and at low cost.”

John Abbott, Chief Business Officer at Yoti, said:

“We’re excited to see Yoti’s secure technology and operations combined with the Post Office identity services and network. Privacy, security and simplicity are at the heart of our solutions, designed to put individuals in control of their data and make it easy for businesses to join our trusted network.

“Together, our unique partnership will provide a suite of services including identity verification, esigning and authentication that leverage privacy-preserving AI and advanced encryption to protect people’s important personal data. We’ll remove the barriers between the online world and high street with our shared values of inclusivity and accessibility.”

Yoti has 2 million consumer app downloads in the UK (9m worldwide) and provides identity solutions to businesses including Virgin Atlantic, NCR, the Co-Op, NSPCC and the NHS and Government of Jersey.

Ends

*McKinsey Global Institute Analysis

Background on digital identity services

- Digital identity can include: Name, date of birth, address; Biometrics (for example face recognition, voice recognition); Personal data (e.g. passport number, driving license number, NHS number, health data such as vaccine status); Certifications (for example a university degree, doctor’s qualification, pilot’s licence)

- One in five people in the UK have no ‘root anchor document’ such as a passport or driving licence (Policy Exchange, Verified, 2020). A person without one of these documents who needs to have their identity verified will be able to visit a Post Office branch to complete their identity verification transaction.

-

Digital Identity has the potential to reduce fraud rates, cut customer onboarding costs, boost financial inclusion, and deepen savings and credit for under-banked customers. It can also spur development by enabling digital talent matching and streamlined employee verification, resulting in higher participation in the labour market.

- McKinsey estimate that high adoption of digital identity could help produce economic equivalent of 3% GDP in a typical advanced economy. (McKinsey, What is Good Digital ID, April 2019)

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on its cash and banking; mails and parcels; foreign exchange; and bill payments services.

- Research has found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.

About Yoti - Yoti is a digital identity and biometric technology company that allows organisations to verify identities and trusted credentials online and in person.

- Yoti’s products span identity verification, age verification, document eSigning, access management, and authentication.

- Over 9 million people have downloaded the free Yoti app globally. Yoti is available in English, Spanish, French, German, Portuguese and Polish.

- Yoti is certified to ISO/IEC 27001:2013 for ID Verification Services, ISAE 3000 (SOC 2) Type 2 certified for its technical and organisational security processes